Legacy Giving

How do you want to be remembered?

Through a planned gift, donors can provide ongoing support to Warm Heart programs to build communities and make a better world. Donors can choose structured gifts to be made now or after their lifetimes, and take advantage of financial and tax benefits, which vary by country.

Whether through a gift in your will, a gift of securities or life insurance, retirement plan assets or other financial accounts, a planned gift to Warm Heart Worldwide will help to build better lives, one community at a time, leaving a legacy of love and compassion.

Whether through a gift in your will, a gift of securities or life insurance, retirement plan assets or other financial accounts, a planned gift to Warm Heart Worldwide will help to build better lives, one community at a time, leaving a legacy of love and compassion.

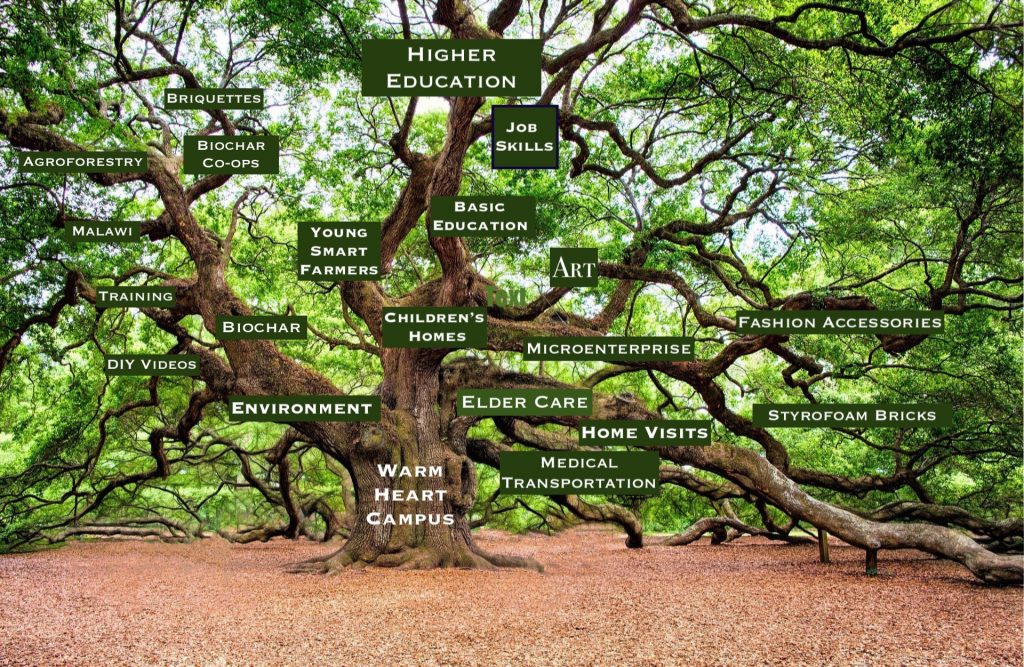

Warm Heart Tree of Life

Gift Planning Options to Leave a Legacy

Gifts by Will

When planning for your future, arranging a legacy gift in your Will or Trust is one of the easiest and most popular ways to support Warm Heart. Your bequest can be made in the following ways:

You can share this sample language with your advisor or attorney:

I give [ __ percent of my estate or description of asset or ___ dollars] to Warm Heart Worldwide, Inc. a registered 501©(3) nonprofit organization, 434 Cedar Avenue, Highland Park, NJ 08904, USA, TIN: 26-2059241 for its unrestricted charitable use and purpose.

When planning for your future, arranging a legacy gift in your Will or Trust is one of the easiest and most popular ways to support Warm Heart. Your bequest can be made in the following ways:

- Residual bequest: a percentage of the remainder of your estate after other specific legacies have been fulfilled.

- Specific bequest: a specific dollar amount or stated fraction of your estate or a specified gift in kind.

- Tax Eliminator bequest: a charitable gift for Warm Heart that is the equivalent of the final income taxes owed by your estate, designed to eliminate those final taxes.

- Contingent bequest: a gift that is originally intended for other beneficiaries but in the event of their prior passing, is redirected as a charitable donation.

- Trust Remainder bequest: Warm Heart receives all or a portion of the remaining principal left from a Trust after the death of surviving beneficiaries or after a term of years specified by the trust deed.

You can share this sample language with your advisor or attorney:

I give [ __ percent of my estate or description of asset or ___ dollars] to Warm Heart Worldwide, Inc. a registered 501©(3) nonprofit organization, 434 Cedar Avenue, Highland Park, NJ 08904, USA, TIN: 26-2059241 for its unrestricted charitable use and purpose.

More Options:

Beneficiary Designation

By simply designating Warm Heart as a beneficiary, you can make a strong commitment to our mission and ensure that your support continues for years to come. Warm Heart can be designated as a beneficiary of a variety of accounts including:

Give by IRA Charitable Distribution

If you are over age 70 ½, you can support Warm Heart directly through your Individual Retirement Account (IRA). Giving a donation to a qualified charity directly from your IRA can yield tax savings for you and provide much-needed support to Warm Heart.

Tribute Gifts

A gift given in the name of a loved one is a meaningful way to honor or memorialize them while supporting Warm Heart.

Endowed Gifts

Your legacy of support can last in perpetuity when you make a gift to our endowment. An endowed gift is invested and a portion of the investment proceeds are used to support the work of Warm Heart on an ongoing basis, creating a lasting memorial. Endowment gifts can be combined with tribute or naming opportunities to enhance your legacy. You can make gifts to the Warm Heart endowment over time with current tax savings.

Donor Advised Funds

A donor advised fund is a flexible gift option with you recommending how much and how often money is granted to Warm Heart and other charities.

We Are Here to Help

Your legacy gift can be one of the most significant acts of generosity that you will carry out. We would love to talk with you to answer any questions and discuss how your support can make a lasting impact.

Please tell us if you’ve already named Warm Heart in your will or estate plan. We would like to say thank you personally for your generosity and commitment and welcome you our community of legacy donors, a special group of supporters like you.

Charitable gifts of Appreciated Stock is another option you may want to consider.

Please contact Jason Highberger at [email protected] for more information.

Beneficiary Designation

By simply designating Warm Heart as a beneficiary, you can make a strong commitment to our mission and ensure that your support continues for years to come. Warm Heart can be designated as a beneficiary of a variety of accounts including:

- Retirement Accounts

- Life Insurance Policies

- Bank or Brokerage Accounts

- Certificates of Deposit

- Donor Advised Funds

Give by IRA Charitable Distribution

If you are over age 70 ½, you can support Warm Heart directly through your Individual Retirement Account (IRA). Giving a donation to a qualified charity directly from your IRA can yield tax savings for you and provide much-needed support to Warm Heart.

Tribute Gifts

A gift given in the name of a loved one is a meaningful way to honor or memorialize them while supporting Warm Heart.

Endowed Gifts

Your legacy of support can last in perpetuity when you make a gift to our endowment. An endowed gift is invested and a portion of the investment proceeds are used to support the work of Warm Heart on an ongoing basis, creating a lasting memorial. Endowment gifts can be combined with tribute or naming opportunities to enhance your legacy. You can make gifts to the Warm Heart endowment over time with current tax savings.

Donor Advised Funds

A donor advised fund is a flexible gift option with you recommending how much and how often money is granted to Warm Heart and other charities.

We Are Here to Help

Your legacy gift can be one of the most significant acts of generosity that you will carry out. We would love to talk with you to answer any questions and discuss how your support can make a lasting impact.

Please tell us if you’ve already named Warm Heart in your will or estate plan. We would like to say thank you personally for your generosity and commitment and welcome you our community of legacy donors, a special group of supporters like you.

Charitable gifts of Appreciated Stock is another option you may want to consider.

Please contact Jason Highberger at [email protected] for more information.